IFRS financial accounting test: Pre-employment screening assessment to hire top candidates

Summary of the Financial accounting (IFRS) test

This financial accounting test evaluates candidates’ ability to record, classify, and summarize accounting transactions according to IFRS. This pre-employment screening test will help you to hire experts with practical financial accounting skills.

Covered skills

Recording & documentation

Classification & summarizing

Reporting & presentation

Interpretation & financial analysis

Use the Financial accounting (IFRS) test to hire

Bookkeepers, accounts assistants, financial accountants, financial managers, and other roles requiring a good grasp of financial accounting.

Type

Time

Languages

Level

About the Financial accounting (IFRS) test

Financial accounting plays an important role in helping businesses track income and expenditures, ensure statutory compliance, and provide investors, management, and government with the financial information they need to make good business decisions.

This financial accounting (IFRS) test evaluates a candidate’s ability across various financial accounting topics ranging from balance sheets and income statements, to cash flow and owners’ equity. The test assesses candidates’ skills in recording and documentation, classification and summarizing, reporting and presentation, interpretation, and financial analysis. All questions are skewed to practical application, assessing the candidate’s ability to prepare books that reflect a true and fair financial position of the reporting entity and handle complex accounting transactions in both full International Financial Reporting Standards (full IFRS) and International Financial Reporting Standards for small and medium entities (IFRS for SMEs).

Candidates who perform well on this test will have a strong grasp of IFRS, and the technical skills needed to perform bookkeeping duties, handle basic and complex accounting processes, prepare financial statements, and interpret financial results.

The test is made by a subject-matter expert

Miruru W.

A practicing Certified Public Accountant (CPA), Miruru has over 25 years of experience in financial reporting, financial management, and tax advisory services. When he is not carrying out audits in accordance with international standards in auditing and financial reporting, you might find Miruru conducting reporting and financial management assignments in a diversity of sectors, including but not limited to agro-processing, farming, petroleum import, retail, construction, and real estate.

Crafted with expert knowledge

TestGorilla’s tests are created by subject matter experts. We assess potential subject-matter experts based on their knowledge, ability, and reputation. Before being published, each test is peer-reviewed by another expert, then calibrated using hundreds of test takers with relevant experience in the subject. Our feedback mechanisms and unique algorithms allow our subject-matter experts to constantly improve their tests.

What our customers are saying

TestGorilla helps me to assess engineers rapidly. Creating assessments for different positions is easy due to pre-existing templates. You can create an assessment in less than 2 minutes. The interface is intuitive and it’s easy to visualize results per assessment.

David Felipe C.

VP of Engineering, Mid-Market (51-1000 emp.)

Any tool can have functions—bells and whistles. Not every tool comes armed with staff passionate about making the user experience positive.

The TestGorilla team only offers useful insights to user challenges, they engage in conversation.

For instance, I recently asked a question about a Python test I intended to implement. Instead of receiving “oh, that test would work perfectly for your solution,” or, “at this time we’re thinking about implementing a solution that may or may not…” I received a direct and straightforward answer with additional thoughts to help shape the solution.

I hope that TestGorilla realizes the value proposition in their work is not only the platform but the type of support that’s provided.

For a bit of context—I am a diversity recruiter trying to create a platform that removes bias from the hiring process and encourages the discovery of new and unseen talent.

David B.

Chief Talent Connector, Small-Business (50 or fewer emp.)

Use TestGorilla to hire the best faster, easier and bias-free

Our screening tests identify the best candidates and make your hiring decisions faster, easier, and bias-free.

Watch how you can use the Financial accounting (IFRS) test

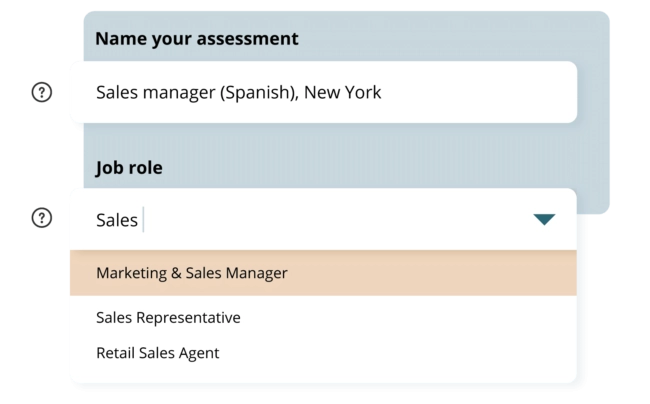

Create high-quality assessments, fast

Building assessments is a breeze with TestGorilla. Get started with these simple steps.

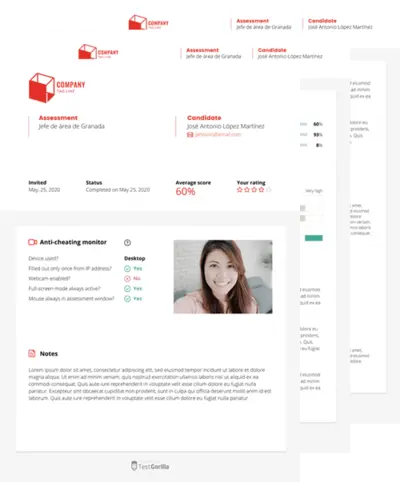

View a sample report

The Financial accounting (IFRS) test will be included in a PDF report along with the other tests from your assessment. You can easily download and share this report with colleagues and candidates.

How to hire finance experts with an accounting assessment test

The Financial Accounting (IFRS) test will help you evaluate your candidates’ abilities to record, classify, and summarize accounting information according to the International Financial Reporting Standards (IFRS). When you hire an accountant to help track your income and expenses, the Financial Accounting (IFRS) test is the best way to ensure you get a top-quality hire. But first, let’s look at why financial accounting is important in today’s business environment.

Why is financial accounting important?

Financial accounting is essential if you want your business to thrive. Good financial accountants provide a variety of services to successful businesses:

• Income tracking• Expense tracking• Ensuring your business is statutory compliant• Providing the leadership and management team with financial information for sound decision-making

The modern economy relies heavily on cross-border transactions (almost a third of all financial transactions). Such transactions used to be complicated because of the differences in national financial/accounting standards. Businesses would therefore find it difficult to track balance sheets according to different national standards, and even a small mistake could compromise the accuracy of their reports.

The solution to this problem was the IFRS system. They created an internationally recognized set of accounting standards based on three components:

Transparency

Transparency is an important factor in accounting, as outlined by IFRS. They ensure transparency by establishing standardized terms and terminologies for accounting operations so that investors and other participants can make informed economic decisions.

Accountability

IFRS identifies accountability as reducing the information gap between people who provide capital and those entrusted with that money. This is crucial when it comes to regulating financial accounting globally.

Efficiency

Efficiency in financial accounting means helping investors understand which opportunities are low and high risk across the world, thus improving capital allocation and removing unnecessary risks from the equation. IFRS achieved this by establishing a single accounting language that reduces international reporting costs and ensures all investors understand the reports.

What is the IFRS system?

The IFRS system provides extensive rules when it comes to the following accounting categories:

• Statement of Financial Position: The IFRS system requires detailed information in the statement of financial position (commonly known as the balance sheet).

• Statement of Comprehensive Income: The standards provide guidelines on how to make a statement of comprehensive income, whether it’s a single statement or a profit or loss statement.

• Statement of Changes in Equity: This statement refers to the changes to your organization’s profits over a period of time, and IFRS provides guidelines on what statements should include.

• Statement of Cash Flow: The IFRS system requires this statement to include a summary of your financial transactions, separated into financing, operations and investing.

The importance of the Financial Accounting (IFRS) test

When hiring an accountant for your organization, you should ask applicants to complete an accounting assessment test, like our Financial Accounting (IFRS) test. This test will help you evaluate candidates and see if they’re skilled in the following financial tasks:

• Recording and documentation• Classification and summarizing• Reporting and presentation• Interpretation and financial analysis

The test is ideal for any of the following roles:

• Bookkeeper• Account assistant• Financial accountant• Financial manager• Any role that requires the candidate to know a lot when it comes to financial accounting.

The IFRS Financial Accounting test will assess your candidates’ understanding of key financial accounting responsibilities, such as writing balance sheets, income statements, cash flow, and owner’s equity.

The questions in the test measure the candidate’s experience and target practical application instead of theorizing. We want you to find a candidate who knows how to prepare your organization's books truthfully and fairly, will carry out complex accounting transactions and will ensure that all of the company's financial accounting is under IFRS guidelines.

Candidates who score well on this accounting assessment test will be skilled and experienced in financial accounting and have a strong grasp of IFRS.

Here’s how the IFRS Financial Accounting test improves your recruitment process

Inviting your candidates to complete our Financial Accounting (IFRS) test will benefit your hiring process in various ways, including the following:

• Creating a bias-free hiring process: TestGorilla’s pre-employment tests eliminate unconscious bias in your hiring process. Simply give all your candidates the test and wait for the results. All candidates are thus evaluated solely on their skills – rather than their CVs, which is a notoriously biased way to assess applications.

• Providing objective results: All your candidates receive the same test, and the results you receive are numerical. This means you can compare candidates easily and all candidates compete on a level playing field.

• Simplicity and accessibility: Using a pre-employment test is easy and simple. Your hiring manager sends the test with a single click to all candidates, whether there are 20 or 220 candidates. This makes pre-employment tests a scalable solution compared to CV screening which is time-consuming and doesn’t do well with a large number of candidates.

Hire skilled financial accounting professionals with TestGorilla

When hiring a candidate to conduct financial accounting in your company, you need to ensure your hire the right person. To help you find the best candidate, an accounting assessment test can help you evaluate candidates on financial accounting, soft skills, and more.

TestGorilla’s IFRS Financial Accounting test is created by an expert. This means your candidates are evaluated on the most critical skills for the job.

In addition, TestGorilla has integrations with a variety of applicant tracking systems or ATS, to help you further streamline your hiring process, cut costs and give your candidates the best application experience.

Stop reviewing CVs and use TestGorilla’s Financial Accounting test to evaluate candidate skills today.